SDIRAs are frequently utilized by palms-on traders who will be prepared to tackle the risks and tasks of choosing and vetting their investments. Self directed IRA accounts can even be great for investors who have specialised expertise in a niche marketplace which they wish to invest in.

Minimal Liquidity: A lot of the alternative assets which might be held in an SDIRA, such as real estate property, private fairness, or precious metals, may not be simply liquidated. This may be a problem if you have to entry funds promptly.

As opposed to shares and bonds, alternative assets tend to be tougher to provide or can come with rigid contracts and schedules.

As an investor, on the other hand, your choices are not restricted to shares and bonds if you end up picking to self-direct your retirement accounts. That’s why an SDIRA can change your portfolio.

Real estate is among the most popular options amongst SDIRA holders. That’s since you are able to spend money on any type of housing using a self-directed IRA.

Put simply, when you’re searching for a tax effective way to construct a portfolio that’s more personalized for your pursuits and skills, an SDIRA might be the answer.

Complexity and Obligation: With an SDIRA, you have more control over your investments, but you also bear extra accountability.

A lot of buyers are surprised to learn that working with retirement money to speculate in alternative assets is feasible considering the fact that 1974. On the other hand, most brokerage firms and banks center on providing publicly traded securities, like stocks and bonds, mainly because they lack the infrastructure and knowledge to control privately held assets, such as real estate or private equity.

And since some SDIRAs for instance self-directed classic IRAs are subject to required bare minimum distributions (RMDs), you’ll Continue really need to plan in advance to make certain you've plenty of liquidity to satisfy The principles set from the IRS.

The tax advantages are what make SDIRAs eye-catching for many. An SDIRA could be both of those traditional or Roth - the account sort you decide on will count mainly on the investment and tax technique. Examine with the economical advisor or tax advisor if you’re unsure that is greatest to suit your needs.

Be accountable for the way you mature your retirement portfolio by using your specialised understanding and pursuits to speculate in assets that match along with your values. Acquired abilities in real estate property or personal equity? Use it to support your retirement planning.

Creating probably the most of tax-advantaged accounts allows you to hold much more of The cash that you simply spend and generate. Based upon no matter whether you choose a standard self-directed IRA or even a self-directed Roth IRA, you have got the prospective for tax-no cost or tax-deferred development, furnished particular problems are achieved.

Have the freedom to invest in Practically any sort of asset with a threat profile that fits your investment tactic; including assets that have the potential for the next level of return.

The most crucial SDIRA regulations through the IRS that investors will need to be aware of are investment limitations, disqualified folks, and prohibited transactions. Account holders have to abide by SDIRA guidelines and polices in an effort to preserve the tax-advantaged standing in their account.

Entrust can support you in purchasing alternative investments using your retirement resources, and administer the purchasing and marketing of assets that are generally unavailable through banking institutions and brokerage firms.

From time to time, the fees connected with SDIRAs is often bigger and much more challenging than with an everyday IRA. It's because with the enhanced complexity linked to administering the account.

Research: It's termed "self-directed" for the purpose. Having an SDIRA, you happen to be entirely chargeable for totally researching and vetting investments.

A self-directed IRA is undoubtedly an incredibly effective investment auto, nevertheless it’s not for everybody. As being the saying goes: with excellent electric power will come fantastic duty; and using an SDIRA, that couldn’t be extra true. Keep reading to understand why an SDIRA may possibly, try here or may not, be for yourself.

Criminals in some cases prey on SDIRA holders; encouraging them to open accounts for the purpose of earning fraudulent investments. They generally fool buyers by telling them that In case the investment is accepted by a self-directed IRA custodian, it needs to be legit, which isn’t correct. Again, You should definitely do comprehensive homework on all investments you select.

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Michael J. Fox Then & Now!

Michael J. Fox Then & Now! Danica McKellar Then & Now!

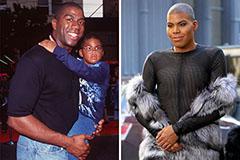

Danica McKellar Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Kane Then & Now!

Kane Then & Now!